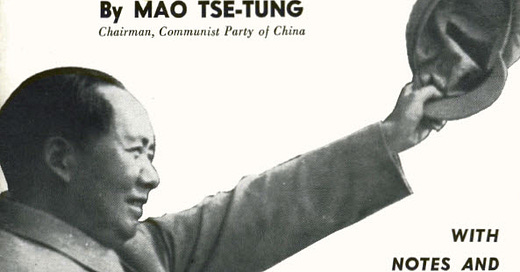

In 1956 Chairman Mao declared a new openness in the Chinese Communist Party. He echoed the Soviet Party’s criticisms of Stalin and declared “Let a hundred flowers bloom.” It wasn’t long before criticism arrived. Wall-posters and speakers began to complain about the Party’s monopoly on power and compared life in China to being in prison.

After five months of “openness,” the trap closed. Mao ordered that criticism was forbidden. People who had spoken out were labeled “Rightists.” Denunciations began and Mao set an official quota of 10% of all intellectuals to be identified as Rightists. Many of those denounced became suicides, their families outcasts. Some were executed.

Mao’s cleverness was in letting his enemies self-identify themselves, saving him the cost of ferreting them out. He said, “How can we catch the snakes if we don’t let them out of their lairs?”1 Most of the people who fell into Mao’s trap were naïve. Courage also played a role, but one must note that speaking out ceased after the “hundred flowers” were plowed under.

In the economic theories prized by my academic colleagues, no one is naïve. Everyone is very clever. But the truth is that a large segment of the citizenry is naïve, innumerate, or subject to problems of self-control. Unprincipled competitors can, like Mao, exploit these human weaknesses, enriching themselves without benefit to society. And, the iron logic of competition may force other companies to follow suit.

I met Toby Walters when I was a consultant to and board member of the Bank Insurance Network, a company that was trying to distribute low-cost insurance through banks. Toby worked in Florida and sold life insurance via mail solicitations. In the direct-mail insurance business, a hit rate of 2 per 1000 was normal. That is, for every 1000 letters sent out, 2 of the recipients ended up buying. Toby’s company had an astounding hit rate of 50 per 1000, twenty-five times the industry norm. Toby’s company wasn’t huge, but it was very profitable. “How do you do this?” I asked.

Toby Walters explained that he bought lists of potential customers from banks like SunTrust. There was nothing special about that. Banks normally sell lists of their clients to marketers. The marketer pays one fee for a simple list of names and addresses, a higher fee to get their birthdays, and so on.

Toby then told me that he focused on customers who had bought credit-life insurance. We both knew what that meant. Credit-life insurance is sold by the bank as an optional add-on to a new consumer loan. The credit-life insurance policy pays off the loan if the borrower dies before the loan has been fully paid. The key is that credit life is a guaranteed issue policy—there is no health checkup. If you are under 60 it is automatically granted. The catch is that it is very expensive, much more expensive than normal term life insurance. Unless you are terminally ill, it doesn’t pay to buy credit-life insurance. So, the people buying it were self-identified as either very ill or naive.

Toby continued:

I buy a list of credit-life customers and their loan paid-up dates. These are people who have already shown their interest in life insurance. I wait until a month before the paid-up date and then send a letter. It says “Your life-insurance is about to expire. Re-insure now.

Toby knew his product was overpriced, but he only marketed to people who had already signaled their interest in buying insurance combined with a lack of sophistication about price. Like the speakers at Mao’s “hundred flowers” seminars, Toby’s customers had self-identified themselves as targets and Toby exploited that fact.

More generally, there are sellers who routinely exploit buyers’ lack of knowledge, their inertia, and their lack of self-control. You will find them in industries ranging from pay-day loans and low teaser-rate mortgages to tobacco and crack cocaine. It is part of the dark side of freedom and business.

I am reminded of human weakness every time my cell phone rings with some person or recording telling me that “the social security office needs information” or that someone has just bought an Apple iPad for me and delivery information is required. These calls would not happen if there were not people credulous enough to respond.

Other examples are the growing problems of drug and Internet addictions. Both have been amplified by lowered prices and ease of access. In both cases, once the unwary person signals their interest in the product the trap closes, and other sources of joy, spirit, and ideas are neglected. In the case of social media, the feedback loop between what is seen and what is then presented explains at least a part of the current balkanization of society. I would love to suggest a simple policy remedy for these social dysfunctions. But I suspect that the ultimate answer is the traditional one—-a society must seek more for its children than that they “be happy” or “be successful.” The young need to be taught to see and resist certain temptations.

Mao, Center for Chinese Research Materials, Vol. 1, pp 190-232, quoted by Jung Chang and Jon Halliday, Mao: The Unknown Story, London: Vintage, 2006, p. 509.

https://edition.cnn.com/2022/07/05/china/china-billion-people-data-leak-intl-hnk/index.html